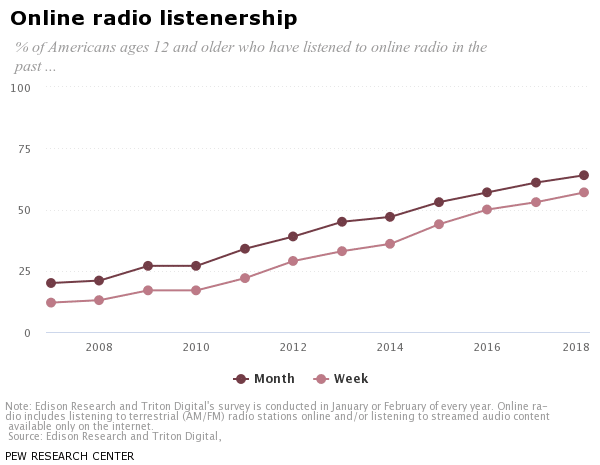

Online radio companies have increased in popularity over the past several years, corresponding with the increase in radio streaming devices, such as smartphones. According to “The Infinite Dial” report by Edison Research and Triton Digital, the portion of the public listening to online radio continues to grow. As of early 2018, 64% of Americans ages 12 and older had listened to online radio in the past month, while 57% had listened in the past week. This is up slightly from 61% and 53%, respectively, in 2017, continuing online radio’s steady year-over-year growth.

In fact, U.S. radio industry revenues made up slightly less than half of the total revenue earned worldwide from the radio industry. In 2015, global radio revenue totaled 47 billion U.S. dollars and a steady yearly growth has been forecasted until 2018. The increased revenues could be attributed to the ways in which consumers have listened to the radio and utilized the range of platforms available to them. Radio stations can now be accessed through smartphone apps, on PCs, laptops, and tablets, in the car and not forgetting, of course, the traditional radio set at home.

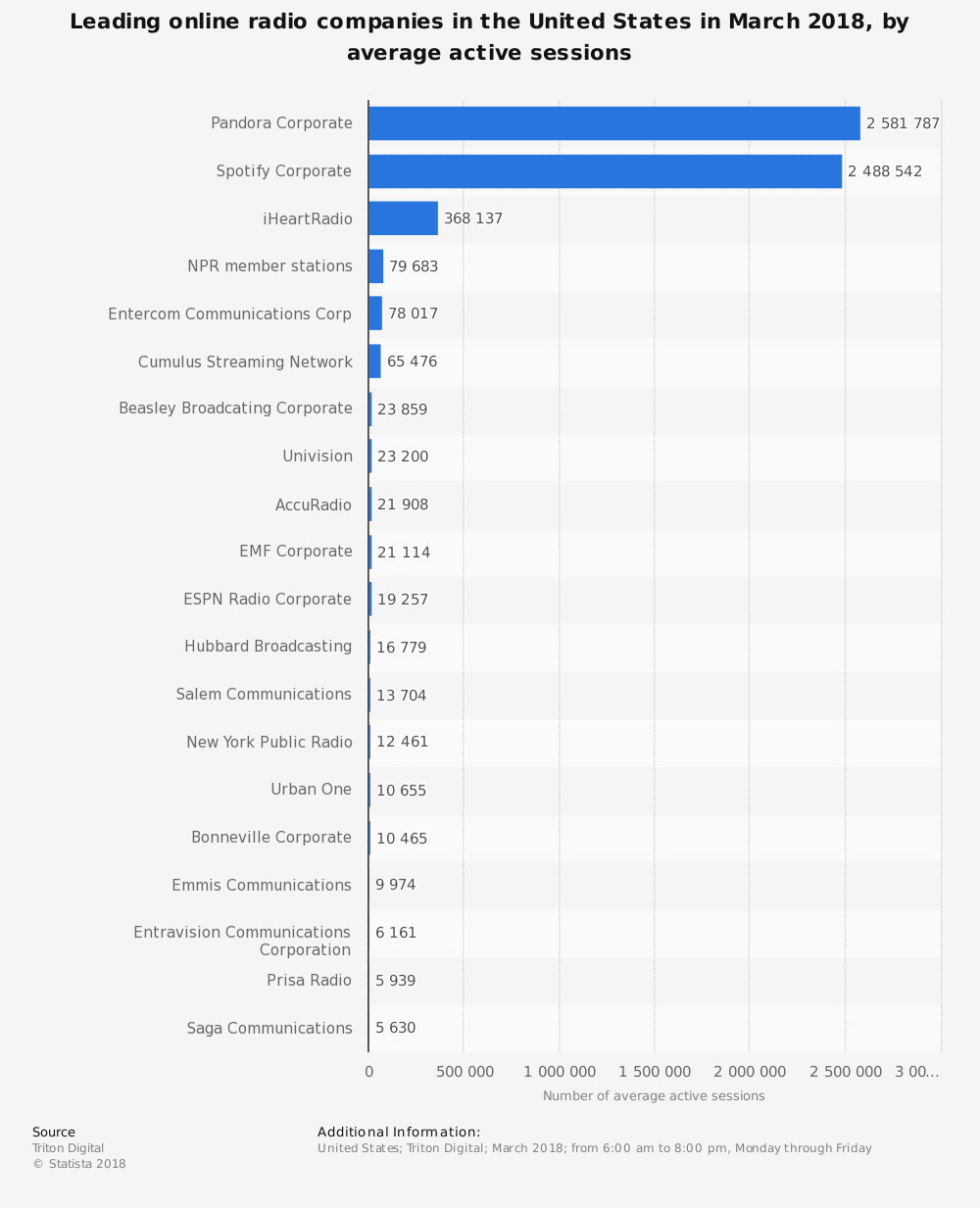

As of March 2018 and according to Triton Digital, Pandora and Spotify are the leading online radio companies* in terms of active users, with the rest being significantly behind.

*Note: Apple Music is technically number 2 but hasn’t included due to the unavailable data.

Pandora is the largest player in the US due to being in the market since 2000 and it’s accumulated free user base, however, Spotify has caught up in recent years.

Here’s what analysts at Goodwater Capital, a consumer tech investment firm, said Spotify did right in its path to an initial public offering.

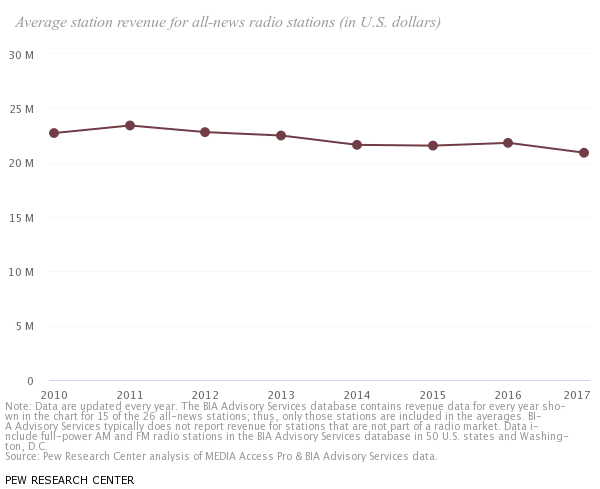

The shift to subscriptions and the increasing number of smaller digital radio stations is resulting in the decline of advertising revenue.

So what are the leading incumbents doing to shift towards more sustainable business models? Spotify is doubling down on its premium subscriber base whilst Pandora is doubling down on its free user subscriber base. And here’s how they are doing it through programmatic audio.

On the one hand, Spotify’s strength has always been in its utility service and technology in order to provide the right music at the right time for its users. However, it is working on solidifying its platform as a programmatic enabled destination to not increase it’s bundled value in new content like TV and movies for existing users, but also grow their audience in podcasting and programmatic enabled audio. Doing so will give them time to apply the same UX for podcasts and strengthen the programmatic solution its sales team can offer directly to its demand-side publishers.

Pandora, on the other hand, is already the largest player in radio ads (technically considered as a radio station network). It previously had an issue where users weren’t able to play on-demand music, but now that’s been addressed, with the condition of watching a 15-second video ad first. But rather than relying on the content consumption it’s strategy is to focus on improving user engagement and embracing a more data-driven marketing strategy and investing more heavily in teams with ad-tech expertise automation that can increase ad impression value.

Content from our partners

In May 2018, Pandora completed its acquisition of AdsWizz and with this, they see a leverage in providing more dynamic and personalized ads to users at the right time.

Ultimately, the consumer side is key to earn audio advertising revenue and it’s through that promise which is how both companies have received significant investment to date, despite being public loss-making companies. History shows that this has been a repeatable pattern and with the lack of differentiation any entertainment or streaming company can come out with their own product and do significantly better.

The key is how Spotify, Pandora and other radio companies continually pursue improving the quality of their overall brand and platform for loyal users.