The old school publisher retools to deliver a customer experience worth paying for.

The New York Times has publicly set itself an ambitious goal, aiming to convince 10 million subscribers to pay for its quality journalism. Contrary to persistent claims that The Times is “failing,” the company continues to steadily grow its digital subscriber base. Having acknowledged that historically, The Times was late to embrace digital transformation, by their own latest figures, their subscriber count currently stands around 2.8 million — enough for the brand to claim the self-appointed title of “most successful digital news subscription business in the world.” Alongside other trailblazers like Axios and The Washington Post, The Times in creating a market for online subscriber-funded journalism that simply hasn’t existed at scale before. Digital-savvy is a new look for the brand still referred to in media circles as the “Grey Lady”—an image firmly anchored in the print era. To achieve its unparalleled success to date, The Times has retrained itself — thinking less like a rarified news publisher, and more like a consumer subscription brand. A series of interviews given so far this year, including a recent live appearance by the C.O.O. herself, offer insights into how the business is managing this behind the curtain. Connecting the dots, a picture emerges of the strategy behind the success, some fundamental shifts in thinking, and a few of the changes still ahead as the Times continues to navigate their way toward 10 million.Converting readers in a “subscriber-first” strategy

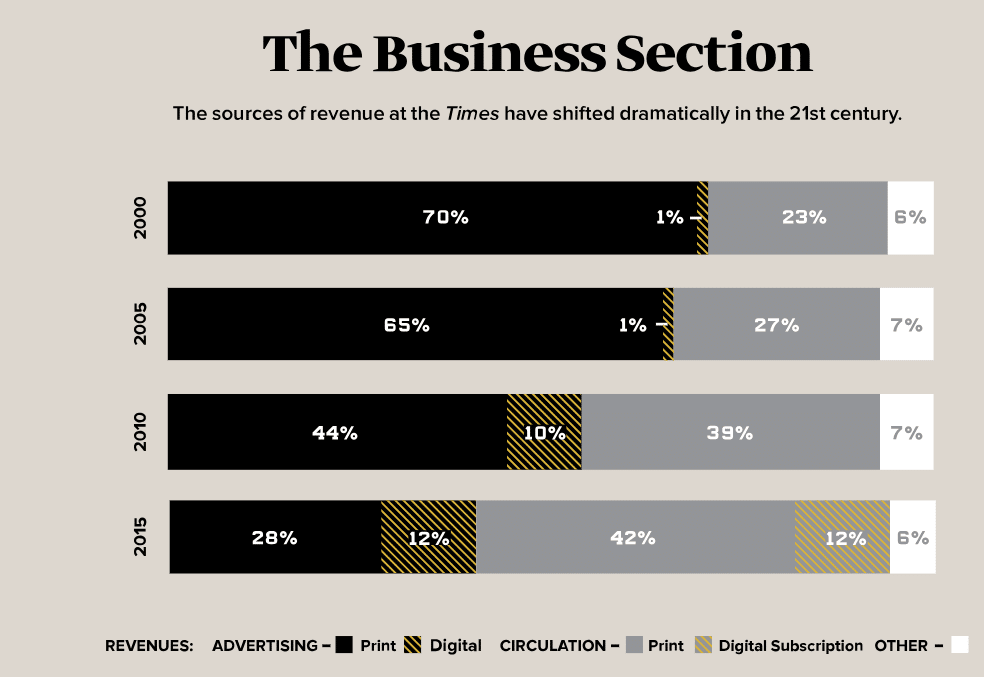

The New York Times has pegged a subscription model as the future of the business since “Our Path Forward,” the paper’s seminal 2015 response to declining revenues from print and digital ads. Since then, The Times has not only benefited from an industry-wide “Trump-bump” in post-election traffic but successfully converted the momentary uptick in traffic to actual paying subscribers. As hoped, those additional subscribers are sticking around, contributing to total revenue growth that’s offset declines in digital ad revenue. A major part of that success has involved a fundamental rethink of customer relationship management — taking a page out of the marketing playbook of popular consumer subscription platforms like Netflix, HBO, and Spotify. The elevation of Ms. Kopit Levien to Chief Operating Officer epitomizes that shift. In her role, she oversees “the teams responsible for digital product, design, audience and brand, consumer revenue, advertising, live events and new product development” — a broad remit that spans the entire customer experience, as well as its monetization.

From Wired Magazine’s “How The New York Times Is Clawing Its Way Into The Future,” February 2018.

The paywall is the primary point of conversion in the customer journey, but the company has become increasingly sophisticated in its appeals — personalizing targeting tactics based on each user’s behavior and content preferences. A prime example of habit-forming relationship-management is the Times’ portfolio of regular emails, which has grown to include more than 50 distinct offerings. “That growth matters,” according to Ben Cotton, Executive Director of Retention and Customer Experience “because newsletter [email] subscribers are twice as likely as regular New York Times readers to become [paying] subscribers.” An insight like that, born from measurable testing, allows the Times to allocate time and resources to products that best encourage promising user engagement. The Times’ new hit podcast The Daily — with over 200 million total downloads and counting — presents the next big opportunity to test conversion tactics, turning broad reach into habitual engagements with paying subscribers as the ultimate goal.Retaining subscribers, reducing churn

With millions of subscribers now acquired in 2018, The Times is turning increasing attention toward retention, keeping the costs of new acquisition down by finding ways to reduce cancellations — the metric unflatteringly referred to as churn. A 25 people team inside the company are devoted to retention. That number tripled between 2015 and 2017, showing how churn has become an increasing concern as subscriptions have grown. Many of these hires were brought in because they think like consumer marketers, according to a recent interview with Cotton, who works under Ms. Kopit Levien.

A nytimes.com overlay to subscribe for access to A Year of Living Better.

This increasing focus has lead the team beyond targeted offers and behavioral nudges, turning to the product itself — the content — to help make the subscription proposition sweeter. To that end, in January, the Times’ launched Year of Living Better guides for subscribers — lifestyle content available only to subscribers. According to Cotton, the test indicated that subscribers who engaged with these features that we did just for them — and even subscribers who just got messaging about them, even if they didn’t always use them — we saw increased reductions in subscribers’ likelihood to churn. More recently, the launch of the The Times latest podcast Caliphate — a behind-the-scenes glimpse into reporting on ISIS — caters to subscribers with early access to each episode.Creating value as a lifestyle brand

The Times has transformed from a relic of the print era. By adopting a digital product mindset, developing applications and managing the customer experience, the company ultimately seeks to optimize engagement and subscriber-growth.